| Market |

Median Asking Rent |

1‑Month Δ |

1‑Year Δ |

Active Listings |

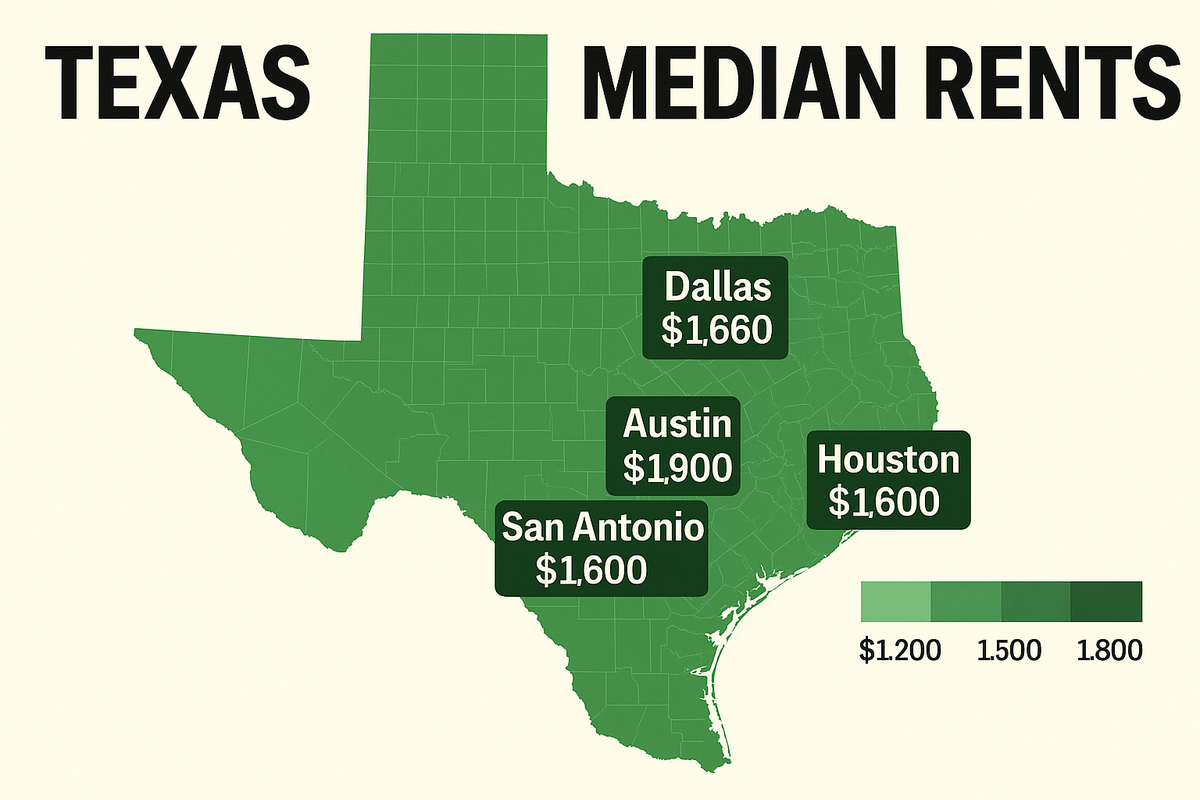

| Texas (statewide) |

$1,750 |

0 $ |

‑$200 |

75,915 |

| Austin |

$1,900 |

+ $22 |

‑$375 |

6,047 |

| Dallas |

$1,650 |

+ $39 |

‑$356 |

3,930 |

| Houston |

$1,660 |

‑ $40 |

‑$239 |

9,203 |

| San Antonio |

$1,600 |

≈0 $ |

‑$125 |

5,667 |

1. Executive takeaways

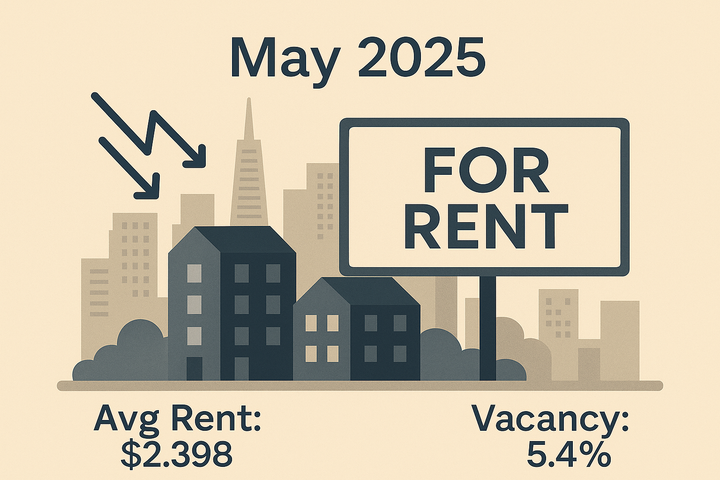

- Statewide rents are running 5 % below the U.S. average ($1,850). After a $200 slide year‑over‑year, prices have flattened month‑to‑month.

- Every major metro is still cheaper than a year ago, but the pace of decline is slowing; Austin and Dallas have already ticked up slightly in the last 30 days.

- Supply is abundant: Zillow lists nearly 76 k available units statewide—roughly one listing for every 50 renter households.

- Developers are hitting the brakes. New‑start volume across Houston, Austin and Dallas fell more than 50 % in Q1‑2025 versus 2023, according to RealPage.

- RealPage expects effective rents to turn positive again (~2.5–3 % YoY) in 2H‑2025 as the construction wave recedes.

2. What’s happening on the ground?

|

Austin |

Dallas–Fort Worth |

Houston |

San Antonio |

| Driver |

Post‑building glut easing; concessions shrinking |

Class‑A oversupply still heavy |

Most affordable of the “big 3”; steady in‑migration |

Budget option; new build‑to‑rent stock |

| Vacancy (RealPage) |

~10 % ↓ |

~12 % → |

~9 % → |

~10.5 % ↑ |

| Typical concessions |

4‑6 wks free + parking |

6‑8 wks free + gift cards |

2‑4 wks free, free move‑in |

1 mo free in luxury |

| 2H‑2025 rent outlook |

+3–4 % |

+1–2 % |

+2.5–3 % |

+1 % |

3. Supply pipeline & new starts

- Record deliveries 2024: ±95 k new units across the “big four” metros.

- Starts plunge: fewer than 6 k units broke ground in Houston in 2024—lowest since 2010.

- 2025 forecast: 14–27 k completions per metro, still high but down ~25–30 % YoY.

4. Affordability check

- Renters spend 28‑30 % of median household income on housing in most large Texas metros; Houston is the standout at ~21 %, Austin the stretch case at ~33 %.

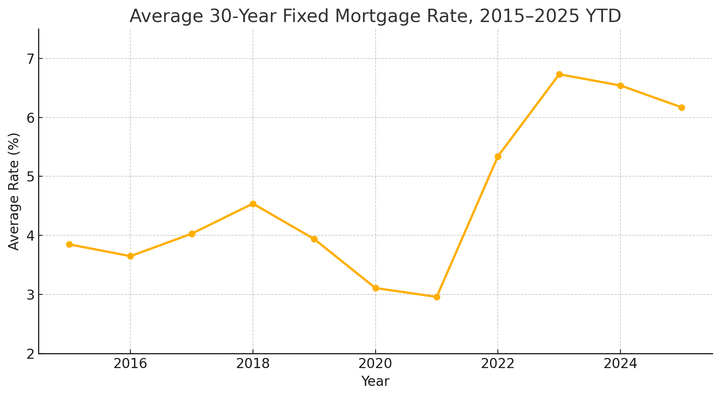

- Renting vs. owning gap: in Austin, monthly ownership costs run ~$1 000 higher than renting; Houston’s gap is ~$850. (Zillow ZHVI & mortgage math.)

5. Tactics for renters (May–July 2025)

- Negotiate: with median time‑on‑market near 30 days, landlords are still offering 1–2 months free in many Class‑A buildings.

- Target new deliveries: lease‑up properties carry the steepest incentives.

- Lock a 14‑ or 15‑month lease to straddle the near‑term bottom before 2026 rebounds.

- Compare ZIPs: Inside Austin, the spread between trendy 78704 ($2,100) and Cedar Park 78613 ($1,530) is almost 30 %.

- Watch “junk fees”: rising insurance costs are being passed through as $15‑30 monthly add‑ons, especially along the Gulf Coast.

6. Outlook to year‑end 2025

| Metric (Texas) |

2024 |

2025 (forecast) |

| Average rent growth (ZORI) |

–1.8 % |

+2.5 % |

| New units delivered |

95 k |

~65 k |

| Average vacancy |

11 % |

9.5 % |

| Typical concessions |

6 wks |

4 wks |

Bottom line: Spring’s renter‑friendly window is closing. As construction starts dry up and absorption normalizes, landlords will regain leverage, pushing rents back into positive territory by late‑2025.

Data sources: Zillow Rental Manager, Zillow Research (ZORI), Apartment List National Rent Report, RealPage Analytics webcast & forecast.

Comments ()