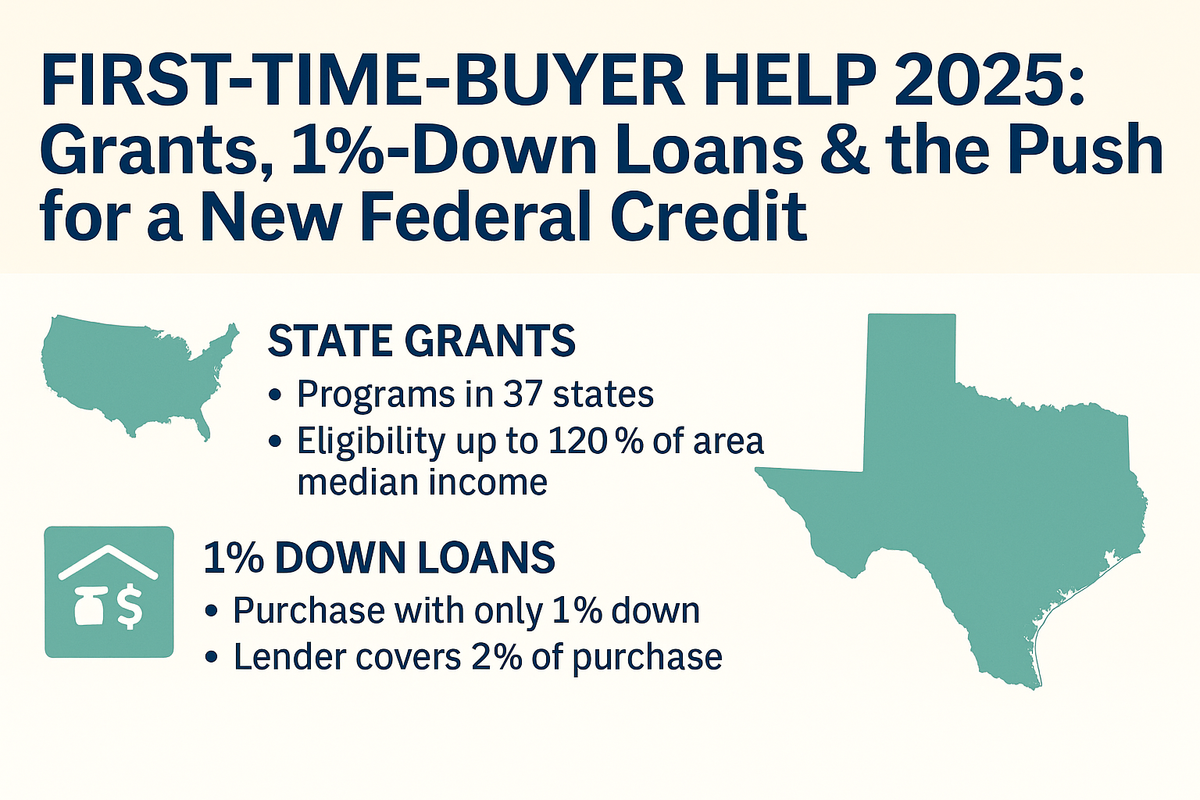

First‑Time‑Buyer Help 2025: Grants, 1 %‑Down Loans & the Push for a New Federal Credit

State programs explode

MortgageReports counts 37 states offering down‑payment grants this year, many with incomes up to 120 % AMI. Average award: $10 500; max: $25 k (DC Open Doors).

Ultra‑low‑down loans spread

Rocket Mortgage’s ONE+ covers 2 % of the purchase so the buyer brings only 1 % (3 % total). Borrowers must stay ≤80 % area‑median income. UWM and CrossCountry quickly launched copycats.

Pros:

- Home sooner; keep emergency fund intact.

Cons: - Higher PMI: 0.75 % vs. FHA’s 0.55 % + upfront premium.

- Equity risk if prices dip 5 %.

Federal landscape

- Downpayment Toward Equity Act (S. 967)—up to $25 k for first‑generation, ≤120 % AMI buyers. Reintroduced March 2025, hearing set for July in Senate Banking.

- Tax credit revival idea: Several House members float a 10 % credit (max $15 k) refundable over five years; draft not yet filed.

Case study: Chicago condo purchase

| Scenario | Upfront cash | Monthly PITI |

|---|---|---|

| FHA 3.5 % + IDHA $10 k grant | $7 600 | $2 310 |

| Rocket ONE+ 1 % + seller 3 % credit | $6 000 | $2 450 |

| Conventional 5 % (no grant) | $18 400 | $2 180 |

Buying with tiny down saves cash, but higher PMI + loan size boosts payment; breakeven depends on appreciation.

Tips for applicants

- Layer programs: Many states allow grants + seller credit + lender DPA.

- Watch recapture clauses: Grants often prorate forgiveness over 5–10 years; move out early, repay.

- Compare PMI vs. MIP: FHA cheaper monthly, but has upfront 1.75 %.

Outlook

Expect lenders to bundle AI‑based homebuyer ed, down‑payment pooling for friends/family, and live grant eligibility checks—making 2025 a unusually favorable window for cash‑light buyers if inventory loosens.

Comments ()