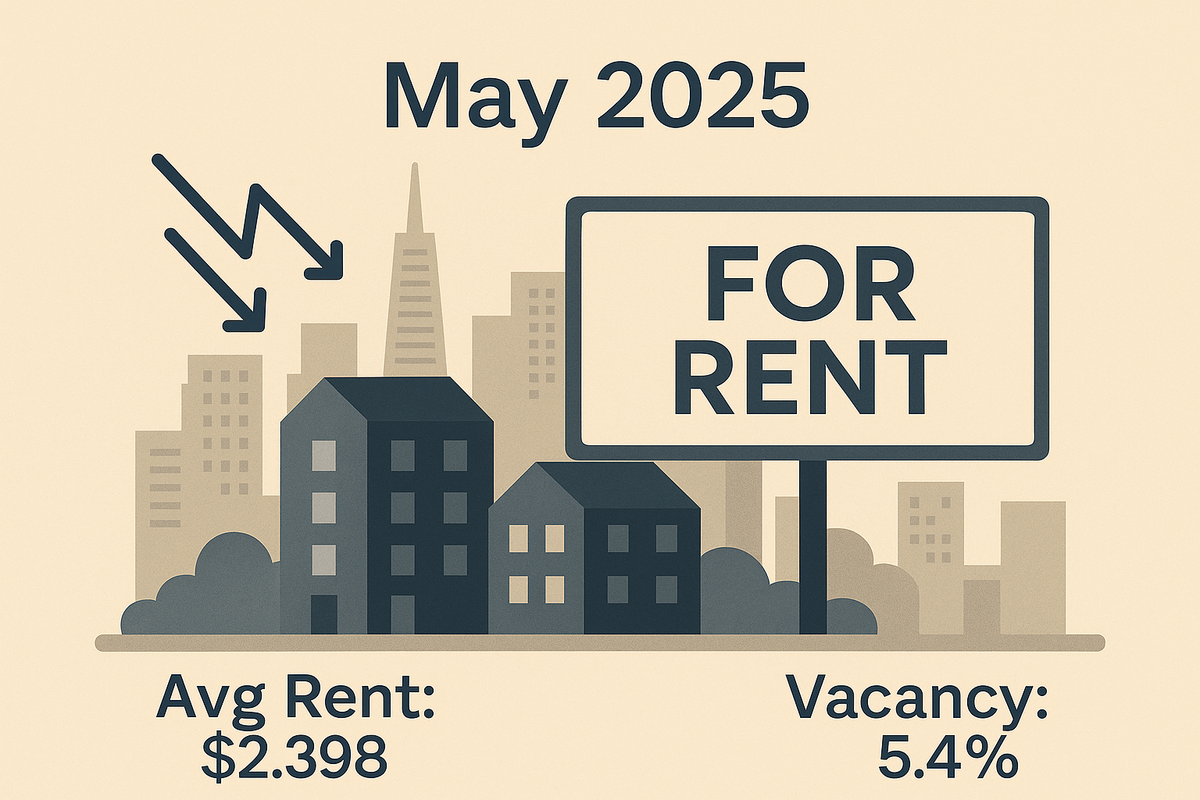

California Rental Market Update — May 2025: Falling Prices, Rising Opportunities

Key State-Level Numbers

- Typical monthly rent: $2,398 (↔ MoM + $3; YoY – 14.4 % / – $403)

- Active listings: ≈ 98 000 rental homes currently on the market (highest since 2020)

- Vacancy rate: 5.4 %, the highest statewide in six years

- Annual income needed: $96 000 to afford median rent under the 30 %-of-income rule (vs. $74 000 national)

- New supply: 42 000 multifamily units delivered over the past 12 months

- Observed renter demand: Running 2 % below 2019 levels, i.e. essentially pre-pandemic normal

- Zillow rent forecast: + 3.1 % for single-family and + 2.1 % for multifamily through end-2025

- Affordability gap: Because the median California rent sits 30 % above the U.S. norm ($1,850), a household now needs about $96 k in annual income to keep the standard “rent = 30 % of income” rule, versus $74 k nationally.

How the Big Metros Compare

| Metro | Typical Rent | MoM Δ | YoY Δ |

|---|---|---|---|

| San Francisco | $2,600 | -$95 | -21.1 % |

| Bay Area (overall) | $3,200 | -$60 | -14.7 % |

| Los Angeles | $2,311 | -$34 | -17.3 % |

| San Diego | $2,800 | $0 | -6.6 % |

| San Jose | $2,588 | -$7 | -11.8 % |

| Sacramento | $1,670 | — | — |

What the table shows

- 2024’s correction has deepened along the coast. San Francisco and Los Angeles are logging the steepest discounts from pandemic-era peaks, thanks to a record pipeline of Class-A apartment deliveries and persistent out-migration.

- Inland metros (Sacramento, Riverside, Fresno – not shown) are closer to price stability, having never spiked as high in 2022–23.

Demand & Affordability Pressures

Zillow’s latest rent report finds that a renter must now earn six-figure salaries in 11 California MSAs just to afford the median lease without becoming rent-burdened. In Los Angeles, a typical tenant spends 36 % of gross income on rent; in San Francisco it’s 41 %.

Yet observed demand (ZORDI) is plateauing rather than collapsing. Page-view and inquiry volumes across California are only 2 % below their 2019 baseline — tenants still need housing; they are simply shopping harder and pushing back on asking prices.

Supply Side

Developers delivered roughly 42 k new multifamily units statewide in the past 12 months — the biggest wave since the 1980s. Combined with thousands of “accidental” single-family rentals left unsold in a high-rate environment, the vacancy rate on Zillow’s platform is hovering near 5.4 %, its highest in six years. This new slack explains why statewide rents are falling even as employment remains strong.

Looking ahead, Zillow Research expects:

- Single-family rents: +3.1 % in calendar-year 2025.

- Multifamily rents: +2.1 %, a pace well below the 2021-22 boom.

Construction starts, however, are already down 25 % from their 2022 peak, so today’s oversupply will gradually burn off through 2026.

What It Means for Renters

- Negotiate, don’t hesitate. With inventory up, landlords are more open to free parking, month-free concessions or modest rent reductions on renewals.

- Consider 12- to 24-month leases. If you secure a favorable rate now, you lock in savings before the next construction lull tightens the market.

- Broaden your search radius. Inland hubs like Sacramento and the Inland Empire sit 10-15 % below coastal prices yet offer similar commute-by-hybrid flexibility.

What It Means for Landlords

- Price realistically. Units listed above the Zillow Rent Index for their ZIP code linger 25 % longer on the market. Use data, not last year’s comps.

- Invest in make-readies. Minor upgrades (smart locks, fresh paint, in-unit laundry) can justify premium pricing even in a cooling market.

- Understand rent caps. California’s statewide AB 1482 allows annual increases up to 5 % + CPI (currently ≈ 8 %), but local ordinances may be stricter.

Outlook Through Early 2026

- Base-case scenario: Statewide rents bottom in Q3 2025, then creep up 1–3 % annually as new-build completions fall off and household formation rebounds.

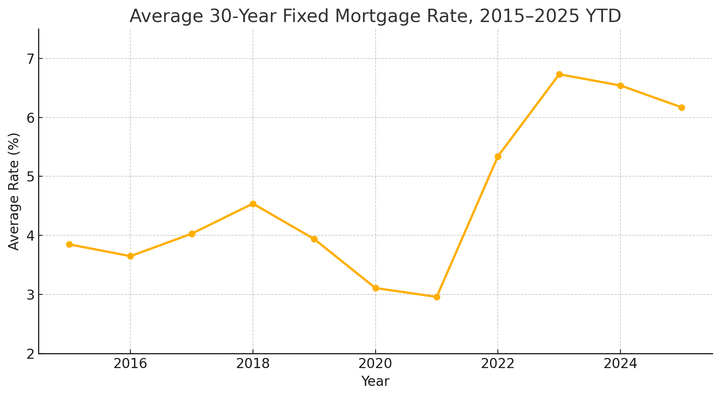

- Upside risk: A sharp drop in mortgage rates could lure renters into home-buying, further softening demand and forcing landlords to keep rents flat.

- Downside risk: If construction financing remains tight, today’s pipeline could be the last big wave for a while, tightening vacancies faster than expected.

In short, 2025 is shaping up as a renter-friendly window: ample supply, softer prices, and room to negotiate. Landlords can still succeed, but only by staying data-driven and competitive. Keep a close eye on inventory trends; the balance of power may shift again by late 2026.

Comments ()